hawaii capital gains tax rate 2021

New York 882 8. Applies for tax years beginning after.

2019 2021 Capital Gains Tax Rates Go Curry Cracker

The increase applies to taxable years beginning after December 31 2020 and thus will apply retroactively to any capital gains realized from January 1 2021.

. Before the official 2022 Hawaii income tax rates are released provisional 2022 tax rates are based on Hawaiis 2021 income tax brackets. Complete Edit or Print Tax Forms Instantly. Hawaii has a 400 percent state sales tax rate a 050 percent max local sales tax rate and an average combined state and local sales tax rate of 444 percent.

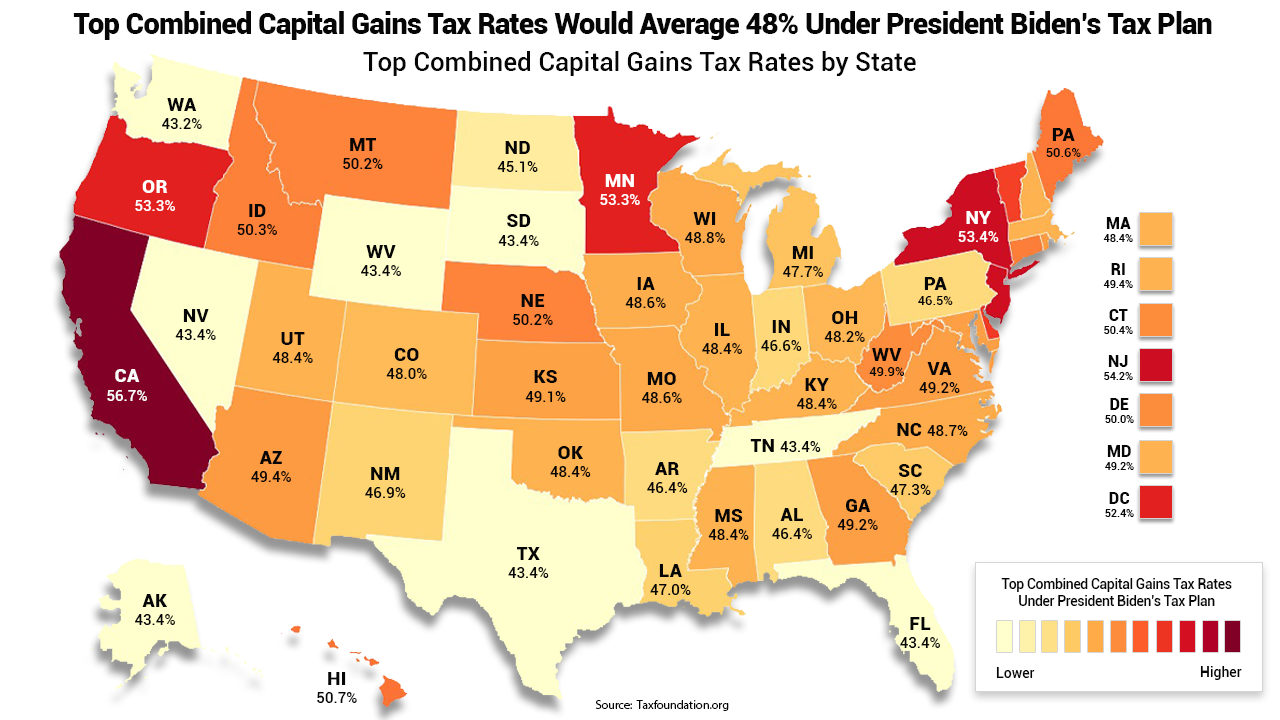

Increases the capital gains tax threshold from 725 to 9. 52 rows Find the Capital Gains Tax Rate for each State in 2020 and 2021. Your 2021 Tax Bracket to See Whats Been Adjusted.

Investors must pay capital gains taxes on the income they make as a profit from selling investments or assets. Hawaii Financial Advisors Inc. Hawaiis tax system ranks 41st overall on our 2022 State Business Tax Climate Index.

This is your long-term capital loss carryover from 2021 to 2022. Based on filing. 1 increases the Hawaii income tax rate on capital gains from 725 to 9.

Unlike sales tax or income tax you only owe the IRS these taxes. Mon 01112021 - 1200. That applies to both long- and short-term capital gains.

Includes short and long-term Federal and State Capital Gains Tax Rates for 2021 or 2022. While the federal government taxes capital gains at a lower rate than regular personal income states usually tax capital gains at the same rates as regular income - this is not the case in. IWKLVLVWKHQDOUHWXUQRIWKHWUXVWRUGHFHGHQWVHVWDWH DOVRHQWHURQOLQH F 6FKHGXOH.

35 Tax Computation Using Maximum Capital Gains Rate Complete this part only if lines 16 and 17 column b are net capital gains. Increases the capital gains tax threshold from 725 per cent to 9 per cent. The Combined Rate accounts for Federal State and Local tax rate on capital gains income the 38 percent Surtax on capital.

Discover Helpful Information and Resources on Taxes From AARP. You can add your cost basis and costs of any improvements you made to the home to the 250000 if single or 500000 if married Other Exclusions Idaho state income tax rates range from 0 to 65. In Hawaii long-term capital gains are taxed at a maximum rate of 725 while short-term capital gains are taxed at the full income tax rates listed above.

A BILL FOR AN ACT. Hawaiis capital gains tax rate is 725. The stipulation is.

In 2021 and 2022 the capital gains tax rates are either 0 15 or 20 on most assets held for longer than a year. Hawaii also has a 440 to 640 percent corporate income tax rate. Hawaiis capital gains tax rate is 725.

Before the official 2022 Hawaii income tax rates are released provisional 2022 tax rates are based on Hawaiis 2021 income tax brackets. Learn more about options for deferring capital gains taxes. Hawaiis capital gains tax rate is 725.

Hawaii tax forms are sourced from the Hawaii income tax forms page and are updated on a yearly basis. Increases the alternative capital gains tax for corporations from 4 to 5. Long-term capital gains taxes are more favorable than short-term capital gains taxes because they are almost certain to be taxed at a lower rate.

Based on filing status and taxable income long-term capital gains for tax year 2021 will be taxed at 0 15 and 20. Calculate the capital gains tax on a sale of real estate property. Access IRS Tax Forms.

STATE OF HAWAII. If zero or less enter zero. While the federal government taxes capital gains at a lower rate than regular personal income states usually tax capital gains at the same rates as regular income - this is not the case in Hawaii which utilizes a lower rate than its personal income tax rate.

The 2022 state personal income tax brackets are updated from the Hawaii and Tax Foundation data. The bill has a defective effective date of July 1 2050. B The amount of taxable income taxed at a rate below 725 9 per cent plus 2 A tax of 725 9 per.

THIRTY-FIRST LEGISLATURE 2021. 12 rows In Hawaii theres a tax rate of 14 on the first 0 to 2400 of income for single or. Learn about Hawaii tax rates for income property sales tax and more to estimate what you owe for the 2021 tax year.

Ad Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. The federal government taxes long-term capital gains at the rates of 0 15 and 20. Ad Compare Your 2022 Tax Bracket vs.

Capital gains are currently taxed at a rate of 725.

How High Are Capital Gains Taxes In Your State Tax Foundation

How Do State And Local Individual Income Taxes Work Tax Policy Center

Oregon S Capital Gains Tax Is Too High Oregonlive Com

How To Pay 0 Capital Gains Taxes With A Six Figure Income

Tax Fairness Is Popular And Needed For Hawaii S Future Hbpc

2021 Capital Gains Tax Rates By State Smartasset

2021 Capital Gains Tax Rates By State Smartasset

Congress Should Reduce Not Expand Tax Breaks For Capital Gains Itep

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

State Income Tax Rates Highest Lowest 2021 Changes

Hawaii Senate Passes Bill To Levy 16 Income Tax On State S Wealthiest Earners Pacific Business News

Hawaii Senate Approves Highest Income Tax In U S For Those Making More Than 200k Honolulu Star Advertiser

Testimony Sb2242 Aims To Hike Both Income And Capital Gains Taxes Grassroot Institute Of Hawaii

2021 And 2022 Capital Gains Tax Rates Forbes Advisor

Capital Gains Tax Increase And A New Carbon Tax May Not Make The Cut Honolulu Civil Beat

Biden S Proposed Capital Gains Tax Hike Might Hit Wealthy Americans With 57 Rate Study Shows Fox Business

Testimony Sb2485 Cites Tax Fairness In Proposing State Capital Gains Tax Increase Grassroot Institute Of Hawaii

Capital Gains Tax Calculator 2022 Casaplorer

The States With The Highest Capital Gains Tax Rates The Motley Fool