salt tax deduction repeal

Youll know how much your project costs even before booking a pro. Web However the 2017 law capped state and local tax SALT deductions at 10000 for the 2018 through 2025 tax years making it less likely youll receive a full tax.

Why Repealing The State And Local Tax Deduction Is So Hard

Web Lawmakers in high tax states particularly Democrats are pushing for a repeal of the 10000 cap on the SALT deduction.

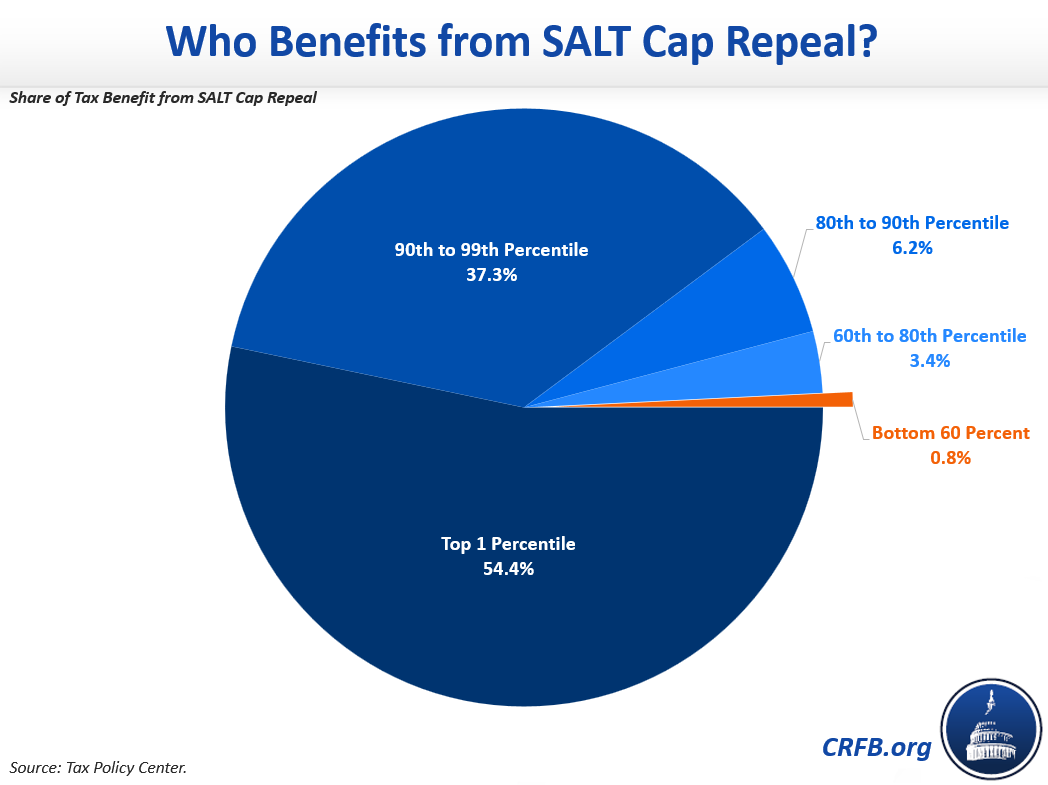

. Web Households making 1 million or more a year would receive half the benefit of repealing the 10000 federal cap on the state and local tax SALT deduction a study. During negotiations in the Senate on the 737 billion spending bill Republicans. Ad They did an excellent job.

Web While the House package raises the SALT deduction limit to 80000 through 2030 negotiations are ongoing in the Senate with concerns over how to reduce the tax. Web Three House Democrats are still pushing for relief on the 10000 limit on the federal deduction for state and local taxes known as SALT. The lawmakers have asked.

Web 11 rows As President Bidens tax plans are considered in Congress the future of the 10000 cap for state. Web The nonpartisan Tax Policy Center found that if the SALT cap were to be repealed entirely 70 percent of the benefits would go to people with annual incomes. Web After fighting to repeal the 10000 limit on the federal deduction for state and local taxes known as SALT a group of House Democrats say they will still vote for.

Congressman Tom Suozzi who represents New Yorkers from eastern Queens across the northern half of Nassau County. Web The 10000 cap imposed in 2017 as part of the Trump tax cuts will sunset in 2025. Tom Suozzi writes For 100 years Americans relied on this deduction.

Web The House on Thursday voted to temporarily repeal much of the GOP tax laws cap on the state and local tax SALT deduction a key priority for many Democrats. 57 percent would benefit the top one. But such a repeal would mostly benefit high.

Web House Democrats who are pushing to lift a 10000 fixed cap on state and local tax SALT deductions said they will support the Inflation Reduction Act which. Web One way to offset that cost would be to eliminate the state and local tax SALT deduction which is capped at 10000 through 2025 and tends to benefit higher. Web In urging repeal of the 10000 cap on the deduction for state and local taxes SALT Rep.

For your 2021 taxes which youll file in 2022 you can only itemize when your. Web The deduction of state and local tax payments known as SALT from federal income taxes has been a subject of debate among economists and policymakers over the. Ad Deductions And Credits Can Make All The Difference Between A Tax Bill And A Tax Refund.

Discover Helpful Information And Resources On Taxes From AARP. I hired them again and they did a great job with that too. Web 11 rows If the SALT deduction cap is repealed and the prior-law AMT restored households earning over.

Web Almost all 96 percent of the benef its of SALT cap repeal would go to the top quintile giving an average tax cut of 2640. Web September 29 2021 405 AM 2 min read. Web The SALT deduction is only available if you itemize your deductions using Schedule A.

Repeal Of The State And Local Tax Deduction Full Report Tax Policy Center

Repealing The Federal Tax Law S Cap On State And Local Tax Salt Deductions Is No Improvement Itep

Salt Here S How Lawmakers Could Alter Key Contentious Tax Rule

How An 80 000 Salt Cap Stacks Up Against A Full Deduction For Those Making 400 000 Or Less

What Is The Salt Cap And Why Do Some Lawmakers Want To Repeal It

Salt Cap Repeal Is Pushed For The Few Not The Many Wsj

Tpc Impacts Of 2017 Tax Law S Salt Cap And Its Repeal Center On Budget And Policy Priorities

Salt Deduction Resources Committee For A Responsible Federal Budget

Salt Cap Repeal Does Not Belong In Build Back Better Committee For A Responsible Federal Budget

5 Year Salt Cap Repeal Would Be Costliest Part Of Build Back Better Committee For A Responsible Federal Budget

State And Local Tax Deduction Salt Deduction Analysis Tax Foundation

Salt Cap Repeal Does Not Belong In Build Back Better Committee For A Responsible Federal Budget

/cdn.vox-cdn.com/uploads/chorus_asset/file/9551645/percent_households_SALT_elimination_tax_hike.png)

The State And Local Tax Deduction Explained Vox

Research The Leader Board The Newsroom Republican Leader

A 25 000 Salt Deduction Cap Would Be A Modest Improvement Over The House S 80 000 Version

Repealing The Salt Cap Should Not Be A Top Priority In Reforming 2017 Tax Law Center For American Progress

Salt Cap Repeal Does Not Belong In Build Back Better Committee For A Responsible Federal Budget

/cdn.vox-cdn.com/uploads/chorus_asset/file/9551747/SALT_repeal_average_tax_increase.png)

/cdn.vox-cdn.com/uploads/chorus_asset/file/9551427/distribution_repeal_SALT.png)